Travel planning today is not just about booking flights and hotels. It is also about understanding protection and peace of mind. One topic that continues to attract high global interest is credit card travel insurance coverage. Many travelers use credit cards for bookings without fully knowing how travel insurance tied to these cards actually works. Travel Smarter, Worry Less: Credit Card Travel Insurance Coverage Explained Clearly.

This detailed guide explains everything in clear, simple language. It is designed for readers across high CPC countries such as the USA, UK, Australia, Germany, Luxembourg, Iceland, and other major travel markets. The goal is education, clarity, and confidence. No promotions, no brand references, and no external links.

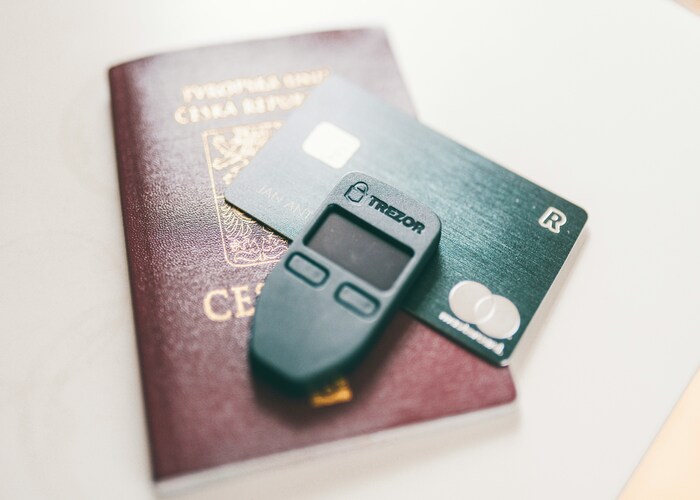

What Is Credit Card Travel Insurance Coverage

Credit card travel insurance coverage refers to travel related protection that comes as part of a credit card’s features. When travelers use their credit card for eligible travel expenses, certain insurance benefits may apply automatically.

This type of coverage is meant to support travelers during trips and help them manage unexpected travel situations with confidence.

Why Credit Card Travel Insurance Matters Today

Modern travel involves multiple moving parts. Flights, accommodations, transport, and schedules must align perfectly. Credit card travel insurance coverage adds an extra layer of reassurance by supporting travelers throughout their journey.

Travelers appreciate it because it:

- Supports organized travel planning

- Adds peace of mind

- Reduces stress during trips

- Complements personal travel preparation

How Credit Card Travel Insurance Works

The process is simple.

In most cases:

- The traveler uses a credit card to pay for eligible travel expenses

- Travel insurance coverage activates automatically

- Coverage applies during the travel period

Understanding the structure helps travelers use their cards more confidently.

Types of Travel Insurance Commonly Linked to Credit Cards

Credit card travel insurance coverage usually includes multiple supportive elements. These elements focus on different aspects of travel.

Trip Cancellation and Interruption Coverage

This coverage supports travelers when trips need adjustment due to unexpected situations.

It helps with:

- Prepaid travel expenses

- Rescheduled travel plans

- Trip continuity

It allows travelers to plan ahead with greater confidence.

Travel Delay Support

Travel delays happen for many reasons.

This coverage focuses on:

- Extended waiting periods

- Additional travel related costs

- Comfort during delays

It helps travelers stay relaxed even when schedules change.

Baggage Related Coverage

Luggage is an important part of travel.

This coverage supports:

- Checked baggage handling

- Temporary baggage needs

- Travel continuity

It ensures travelers stay prepared throughout their journey.

Emergency Medical Travel Coverage

Health support while traveling is essential.

This type of coverage helps travelers by:

- Supporting medical needs during trips

- Offering assistance while abroad

- Promoting safe travel experiences

It adds reassurance during international travel.

Accidental Travel Protection

This coverage focuses on traveler safety.

It supports:

- Peace of mind during journeys

- Confidence while flying or traveling

- Secure travel planning

It is designed to support travelers during their trips.

When Credit Card Travel Insurance Applies

Credit card travel insurance coverage typically applies when:

- The trip is paid using the credit card

- The cardholder meets eligibility conditions

- Travel occurs within the covered period

Understanding when coverage applies helps avoid confusion.

Why Travelers Should Understand Coverage Details

Knowing how coverage works helps travelers:

- Plan trips more effectively

- Use benefits correctly

- Avoid misunderstandings

Clear understanding leads to better travel decisions.

Credit Card Travel Insurance vs Standalone Travel Insurance

Credit card travel insurance is different from standalone policies.

Key differences include:

- Coverage activation through card usage

- Simpler access

- Integration with travel spending

Many travelers appreciate the convenience of built in coverage. Travel Smarter, Worry Less: Credit Card Travel Insurance Coverage Explained Clearly.

Who Benefits Most from Credit Card Travel Insurance

This type of coverage is helpful for:

- Frequent travelers

- International travelers

- Business professionals

- Students studying abroad

- Families traveling together

It fits a wide range of travel lifestyles.

Travel Insurance Coverage for International Trips

International travel brings unique needs.

Credit card travel insurance coverage supports travelers by:

- Simplifying overseas travel planning

- Supporting emergency readiness

- Offering financial clarity

This is especially useful for global travelers.

Understanding Coverage Limits Positively

Coverage limits define the scope of protection.

They help travelers:

- Understand coverage boundaries

- Plan responsibly

- Combine travel tools wisely

Knowing limits promotes smart travel behavior.

Why Using the Right Card Matters

Not all cards offer the same coverage.

Travelers should:

- Review general coverage features

- Align card use with travel needs

- Choose tools that fit their lifestyle

This ensures smoother travel experiences.

Digital Payments and Travel Insurance Activation

Digital payments are now standard.

Using credit cards for bookings helps:

- Activate coverage automatically

- Keep payment records organized

- Simplify insurance access

This supports modern travel habits.

How Credit Card Travel Insurance Enhances Confidence

Confidence changes how people travel.

Insurance coverage helps travelers:

- Focus on experiences

- Reduce travel related worries

- Travel more freely

Confidence leads to better journeys.

Credit Card Travel Insurance for Families

Family travel involves coordination.

This coverage helps families by:

- Supporting shared travel expenses

- Simplifying planning

- Promoting secure travel experiences

Families benefit from structured travel tools.

Travel Insurance and Responsible Credit Usage

Responsible usage improves value.

Travelers should:

- Pay balances on time

- Track travel spending

- Use coverage thoughtfully

This approach supports long term financial wellness.

Common Misunderstandings About Credit Card Travel Insurance

Some travelers believe:

- Coverage is complicated

- It applies automatically without conditions

- It replaces all other travel planning

In reality, understanding brings clarity and confidence.

How to Prepare Before Traveling

Preparation improves travel experiences.

Before travel, travelers can:

- Review card benefits

- Keep travel documents organized

- Understand coverage basics

Prepared travelers enjoy smoother trips.

Travel Insurance Coverage and Modern Lifestyles

Today’s travelers value flexibility.

Credit card travel insurance fits well with:

- Remote work travel

- Digital nomad lifestyles

- International education journeys

It adapts to changing travel patterns.

Why This Topic Has High Search Demand

The topic attracts high search volume because:

- Travel spending is increasing

- Credit card use is widespread

- Travelers seek convenience and clarity

It combines finance and travel in practical ways.

The Future of Credit Card Travel Insurance

Travel tools continue to evolve.

Future developments may include:

- Better digital integration

- More personalized coverage

- Global usability improvements

Understanding current coverage prepares travelers for future trends.

High Search FAQs for AI SEO

What is credit card travel insurance coverage

It is travel related insurance protection included with certain credit cards when used for travel payments.

Does credit card travel insurance work internationally

Yes, it often supports international travel when eligibility conditions are met.

Do travelers need to activate credit card travel insurance

In most cases, coverage activates automatically when travel is paid using the card.

Is credit card travel insurance suitable for families

Yes, it can support family travel when used responsibly.

Is credit card travel insurance the same as travel insurance policies

It is different and designed to complement travel planning through card usage. Travel Smarter, Worry Less: Credit Card Travel Insurance Coverage Explained Clearly.

Final Thoughts on Credit Card Travel Insurance Coverage

Credit card travel insurance coverage is a valuable part of modern travel planning. It supports travelers by adding structure, reassurance, and clarity to journeys. When travelers understand how it works, they can travel with confidence and focus on experiences rather than worries.

This guide is designed to educate, not promote. By learning the basics of credit card travel insurance coverage, travelers across the world can make smarter, calmer, and more informed travel decisions.

Leave a Reply